Using AI in Financial Services: A Game-Changer for Customer Acquisition

How AI Is Revolutionizing Customer Acquisition Through Personalization, Predictive Analytics, and Enhanced Engagement

Artificial intelligence (AI) is reshaping the financial services industry, driving transformative improvements in customer acquisition strategies. By leveraging AI’s capabilities, financial institutions are enhancing personalization, optimizing targeting, and increasing operational efficiency at every stage of the sales funnel. With $35 billion invested in AI initiatives in 2023—including $21 billion from the banking sector—the technology is already delivering impressive returns on investment (ROI).

In this blog, we explore how AI is revolutionizing customer acquisition in financial services, diving into real-world use cases, key value drivers, and the long-term implications of embracing AI strategically.

Key Drivers of AI Value in Financial Services

1. Operational Efficiency and Scalability

AI-powered solutions streamline processes, reduce manual effort, and enable organizations to handle larger customer volumes without compromising quality.

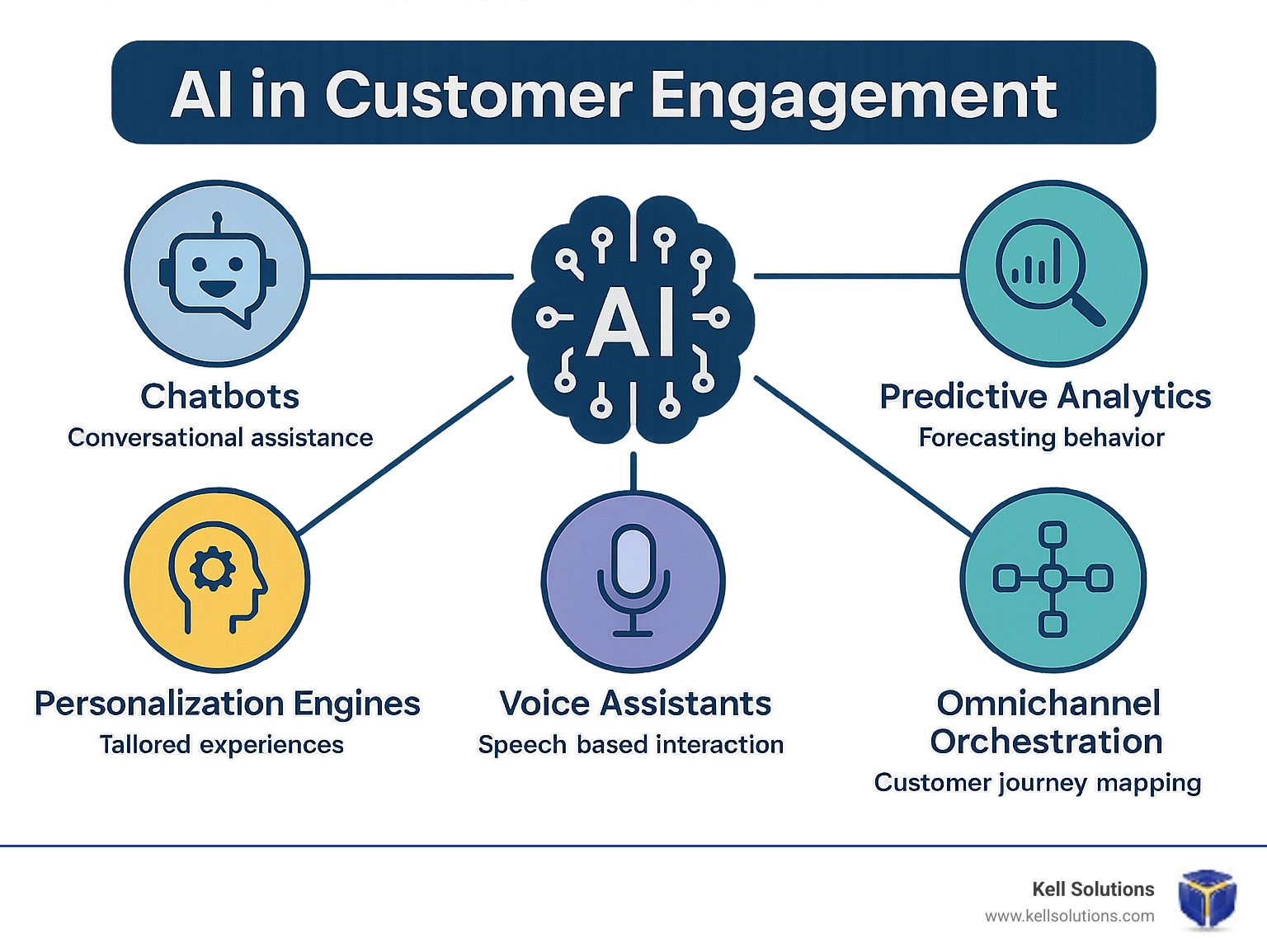

2. Real-Time Personalization

AI enhances customer experiences by delivering tailored messages, offers, and solutions that resonate with individual needs and preferences.

3. Improved Decision-Making and Risk Management

From credit scoring to fraud detection, AI provides actionable insights that reduce risks and optimize decision-making.

4. Enhanced Innovation

AI opens doors to new opportunities, such as automated wealth management and predictive analytics, driving innovation across financial products and services.

AI in Financial Services: Transforming the Customer Acquisition Funnel

Top Funnel: Building Awareness with AI

Content Generation and Personalization

Creating personalized content at scale can overwhelm traditional marketing teams. AI simplifies this process by generating briefs, storyboards, copy, images, and videos tailored to specific customer segments. Marketing teams leverage AI to:

- Reduce content production time.

- Enhance relevance through precise audience targeting.

- Boost engagement rates by aligning messages with customer needs.

AI-Enhanced Media Buying and Ad Targeting

AI reshapes ad targeting by analyzing vast data sets to identify high-value customer segments. For example, Klarna’s use of AI-driven media buying reduced marketing costs by $10 million while improving ad placement efficiency.

Predictive Analytics for Targeting

AI enables financial institutions to refine targeting efforts by analyzing historical data, demographics, and transactional behaviors. Predictive analytics can increase engagement metrics by up to 20%, ensuring marketing efforts reach the right audience.

Middle Funnel: Engaging and Nurturing Leads

Advanced Scoring and Assessment

AI-powered models go beyond traditional credit assessments by incorporating non-traditional data, such as payment history and digital footprints. These models:

- Expand market reach.

- Improve approval rates.

- Reduce default risks.

Streamlined Loan Underwriting and Application Processes

AI accelerates traditionally labor-intensive processes, increasing loan processing capacity by 30%. This efficiency benefits both customers and financial institutions, shortening decision-making timelines.

Conversational AI and Chatbots

AI-powered chatbots like Bank of America’s Erica enhance the customer experience by:

Handling routine inquiries.

Guiding customers through complex applications.

Providing real-time responses that improve satisfaction and reduce churn.

Bottom Funnel: Driving Purchases with AI

Cross-Selling and Upselling

AI analyzes transaction histories and behavioral patterns to recommend relevant products and services. Financial institutions using AI-driven cross-sell strategies report a 15% increase in revenue per customer.

Personalized Recommendations in Wealth Management

AI enables financial advisors to offer tailored investment advice by analyzing client goals, risk tolerance, and market trends. This approach increases client engagement by up to 25%, fostering loyalty and long-term relationships.

How Data Powers AI-Driven Customer Acquisition

Data is the foundation of AI’s effectiveness in financial services. Successful implementation requires integrating diverse data sources—from web forms to transactional databases—into centralized warehouses or lakes. For example:

Improved Predictions: Broader data access enhances AI’s ability to generate accurate predictions.

Personalization at Scale: Unified data formats enable seamless delivery of customized experiences.

As Ryan Swann, Chief Data Analytics Officer at Vanguard, notes: “Data, analytics, and AI are more than strategic assets. It's about synthesizing data to extract business value.”

AI’s Long-Term Impact on Financial Services

AI’s transformative potential extends beyond customer acquisition. Financial institutions investing in AI see tangible ROI across various metrics, including revenue growth and operational efficiency. As generative AI tools mature, their role in enhancing customer retention and driving innovation will only expand.

Key Takeaways for Financial Services Executives

Start Small: Identify specific, high-impact use cases for initial AI implementation.

Focus on Data: Invest in data governance and integration to maximize AI’s predictive capabilities.

Prioritize Ethics: Address concerns around data privacy and algorithmic bias to maintain trust and compliance.

Embrace Continuous Improvement: Treat AI as a long-term investment requiring ongoing updates and optimization.

AI as a Catalyst for Growth

AI is revolutionizing customer acquisition in financial services, offering unparalleled opportunities for personalization, efficiency, and innovation. By strategically implementing AI across the sales funnel, financial institutions can boost engagement, drive conversions, and build lasting customer relationships.

The time to act is now. Start by assessing your existing platforms and data readiness. The sooner you embrace AI’s transformative potential, the faster you can achieve sustained growth and competitive advantage.

Orange County HVAC Google AI Overview Domination: 7 Proven Strategies to Capture Featured AI Results